Seller Finance Mastery Program

by Bruce Whipple

Get Seller Finance Mastery Program by Bruce Whipple Instant Download!

Seller Finance Mastery Program by Bruce Whipple

Overview

Comprehensive Analysis of Bruce Whipple’s Seller Finance Mastery Course

In the business acquisition space, the tools and insights you employ can significantly influence the success of your transactions. One standout resource in this field is the Seller Finance Mastery Program created by Bruce Whipple. This high-level training series is designed for individuals seeking to master the art of acquiring businesses through seller financing. Prioritizing actionable techniques over abstract theories, the course aims to help participants close deals more effectively—without relying on traditional banking channels.

This detailed review takes a closer look at the program’s structure, core modules, advantages, intended participants, and overall relevance in today’s market climate. Whether you're just entering the acquisition arena or refining your current strategies, the content covered here offers meaningful insights.

Program Structure

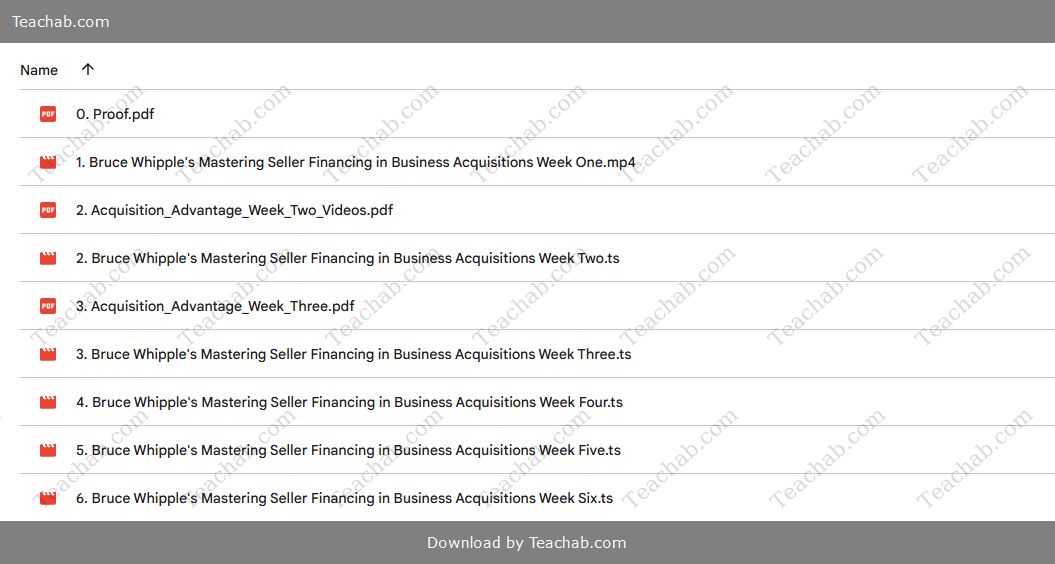

The Seller Finance Mastery Program features six thoroughly designed modules, totaling more than ten hours of expert instruction. Each module includes not only core lessons but also interactive Q&A segments that enhance comprehension and practical engagement.

A key benefit is lifetime access to all course content, allowing users to revisit lessons as needed. This flexibility is especially useful for professionals juggling multiple responsibilities or those who prefer a self-paced learning approach.

Module Overview

Here’s a closer look at what each module offers:

Core Seller Finance Concepts

This opening module lays the groundwork by comparing traditional and alternative financing methods. Bruce explains the psychology behind seller motivations and teaches students how to position themselves as credible buyers—even without a background in acquisitions.Finding Seller-Finance Friendly Deals

This section shows how to locate off-market deals using the “7-D Framework.” Learners discover how to identify highly motivated sellers and expand their deal pipelines efficiently.Deal Evaluation and Selection

Students gain access to Bruce’s proprietary Perfect Deal Filter, along with in-depth due diligence strategies. These tools are essential for identifying businesses with high growth potential and those suited for acquisition roll-ups.Structuring Deals Strategically

This module introduces plug-and-play templates for different deal types. Emphasis is placed on ensuring positive cash flow from day one, along with negotiation tactics that make seller financing an attractive choice for owners.Case Studies and Real Transactions

Drawing on past success stories and occasional failures, this section provides valuable takeaways from real-world experiences. Analyzing diverse deal scenarios offers deeper insights into applying course material.Blueprint for Building an Acquisition Empire

The final module focuses on strategic execution—teaching participants to combine financing techniques, develop a robust team, and manage the critical first 90 days after acquiring a business.

Program Advantages

Participants of the Seller Finance Mastery Program can expect a range of powerful benefits:

Actionable from the Start: Learners frequently report that they can begin applying tactics from the very first session, proving the course’s real-world utility.

High-Level Deal Structuring: This program goes well beyond the basics, offering complex strategies that can increase profits and speed up the acquisition timeline.

Seller-Centric Philosophy: The material encourages a relationship-first approach. By aligning with sellers' goals, students are taught to avoid tactics that depend on hefty upfront cash or adversarial negotiation.

Growth Through Networking: Participants join a learning community of driven professionals, creating opportunities for mentorship, partnerships, and collective growth.

Intended Learners

This course is geared toward those who are seriously pursuing business acquisitions. Ideal participants already understand acquisition fundamentals and are ready to incorporate seller financing into their strategies. It's not a fit for those looking for shortcuts or "get-rich-quick" methods—it requires focus and a genuine interest in high-level deal-making.

Market Relevance Today

With a growing number of baby boomer entrepreneurs nearing retirement, a large pool of businesses is expected to enter the market. Many of these owners prefer non-traditional exit strategies, making seller financing an increasingly practical and strategic option. The skills taught in this course prepare buyers to navigate and capitalize on this evolving landscape.

Traditional Lending vs. Seller Financing

To illustrate the advantages of seller financing over conventional methods, consider the following comparison:

| Aspect | Traditional Financing | Seller Financing |

|---|---|---|

| Approval Process | Lengthy and heavily regulated | Quicker, with more flexibility |

| Credit Dependence | Strong focus on personal credit history | Less reliant on buyer's credit score |

| Closing Speed | Slow, often delayed by red tape | Typically faster and more streamlined |

| Control Dynamics | Lenders may impose restrictive terms | Buyers retain more operational freedom |

| Initial Capital | High upfront capital often required | Lower or negotiable down payments |

This comparison underscores seller financing's flexibility and its potential to accelerate deal completion while maintaining buyer autonomy.

Final Verdict: A Strategic Asset for Deal-Makers

To conclude, Bruce Whipple’s Seller Finance Mastery Program delivers a comprehensive playbook for leveraging seller financing in business acquisitions. It offers in-depth strategies, real-world guidance, and a structured approach tailored to serious buyers. As market conditions shift and more businesses change hands, the skills and techniques shared in this program are more relevant than ever. For buyers seeking to enhance their acquisition capabilities and unlock new deal opportunities, this course could be a pivotal investment in long-term success.