Tax Lien Investing Basics

by Tax Lien Lady

Get Tax Lien Investing Basics by Tax Lien Lady Digital Download!

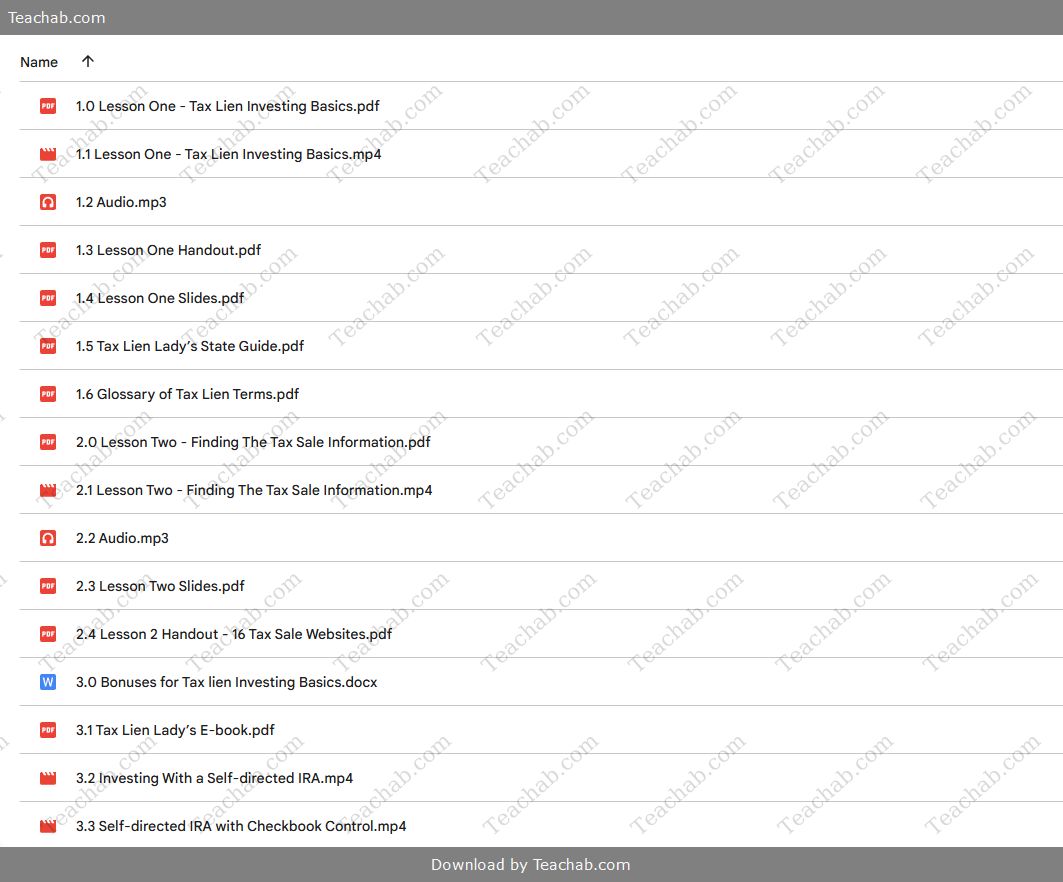

You can check proof of content here

Download immediately Tax Lien Investing Basics by Tax Lien Lady

Overview

Introduction to Tax Lien Investing with Tax Lien Lady

Tax lien investing has attracted attention from investors seeking stable income streams, especially during uncertain economic periods. One key educational resource in this field is the Tax Lien Investing Basics course by Joanne Musa, known as the Tax Lien Lady. This program is designed to offer a clear and thorough introduction to the essential concepts and methods involved in tax lien and tax deed investing. This overview will cover the course’s main features, its benefits, and how it prepares learners to successfully navigate the tax lien market.

This course is ideal for beginners who want a strong foundational grasp of tax lien and tax deed investments without needing prior experience. Its step-by-step structure helps participants understand vital terms and operational procedures. Learners discover the critical differences between tax lien certificates, tax deeds, and redeemable deeds — all important for choosing the investment path that fits their financial goals. Recognizing these distinctions is essential for making wise investment decisions.

Clarifying Tax Liens vs. Tax Deeds

Central to the course is explaining the difference between tax lien certificates and tax deeds. A tax lien certificate represents a legal claim on a property due to unpaid taxes, granting the investor the right to collect the owed amount plus interest once the owner settles their taxes. In contrast, a tax deed grants ownership of the property itself if the taxes remain unpaid, potentially allowing the investor to acquire the property at a significantly reduced price.

Tax Lien Certificates: Legal claims with interest payments on unpaid property taxes.

Tax Deeds: Ownership transfer due to tax default, often yielding major investment opportunities.

Additionally, the course covers which states actively sell tax liens and deeds, providing clear charts and data to help investors identify the best locations with strong tax sale programs. This geographical insight allows participants to understand state-specific rules and pick favorable markets.

Locating Tax Sale Opportunities

One of the course’s valuable features is its focus on how to find accurate tax sale information. Knowing where and how to access this data is key to spotting promising investments. The course offers detailed guidance on using online platforms and resources to find tax sale lists and relevant details, empowering learners to begin investing with limited capital or financial expertise.

It reviews both free and paid tools available for researching tax sales, helping students appreciate how mastering these resources leads to smarter investment decisions and greater confidence in choosing the right liens.

Benefits of Real Estate-Backed Investments

A major draw of tax lien investing is the security provided by real estate backing. This makes tax liens an attractive option for those looking to avoid the volatility of other markets like stocks. The course highlights how tax liens can generate substantial interest returns — in some states, rates may reach as high as 18% to 36%.

This feature positions tax lien investing as a relatively low-risk strategy, especially during economic downturns, making it an appealing alternative for conservative investors seeking consistent income.

Learning Tools and Course Materials

The Tax Lien Investing Basics course offers a diverse range of learning formats, including audio lessons, videos, and downloadable handouts. These resources break down the complexities of tax lien investing into simple, easy-to-follow steps. Catering to various learning preferences, the course ensures every participant can engage with and absorb the content effectively.

The materials focus on guiding students through the process of identifying prime investment locations and collecting essential data, turning the challenge of tax lien investing into an achievable goal.

Avoiding Common Investment Pitfalls

While tax lien investing holds promise, the course dedicates significant time to helping participants steer clear of frequent mistakes. Learning from these common errors protects investors from costly setbacks.

Insufficient Research: Failing to thoroughly investigate properties can lead to poor choices.

Ignoring Local Regulations: Overlooking state-specific tax lien laws may cause legal troubles.

Underestimating Market Risks: Investors learn to account for changes in market conditions and property values.

By addressing these issues upfront, the course helps learners build smarter, more secure investment habits.

Final Summary

In conclusion, Joanne Musa’s Tax Lien Investing Basics course is an excellent starting point for anyone interested in tax lien or tax deed investments. It provides foundational knowledge of key terms, effective research techniques, and an awareness of potential risks. Whether you want to diversify beyond traditional stocks or explore real estate-backed investments, this course offers the essential tools to navigate the tax lien market confidently. With a clear understanding of how tax liens work, investors can make informed decisions that pave the way toward greater financial independence.

Related products

9 Steps to Financial Freedom: Wisdom, Strategies and Tactics for Abundant Wealth (Audiobook)

by John Demartini

$6.30