The Orderflows Blueprint Trading Course

by Mike Valtos

Review of The Orderflows Blueprint Trading Course by Mike Valtos

Check proof of content here:

In the dynamic and often unpredictable world of trading, possessing the right knowledge can be a decisive factor. Understanding how markets truly operate is what separates seasoned professionals from casual participants. Among the educational offerings in this space, Mike Valtos’s Orderflows Blueprint Trading Course positions itself as a powerful tool for traders looking to gain an institutional edge. With more than two decades of experience at high-profile firms such as JP Morgan and Cargill, Valtos shares a level of insight that many retail traders strive to acquire. But how well does his course deliver on its promise? This in-depth review examines the course structure, educational value, benefits, and potential drawbacks to help you decide if it’s the right fit for your trading development.

A Deep Dive into Order Flow Analysis

At the heart of this course lies the methodology of order flow analysis. Unlike traditional technical indicators—often delayed and based on historical trends—order flow analysis zeroes in on real-time trade execution data. It’s akin to watching a live auction rather than reviewing a sales report. This approach helps traders see who is buying and selling, offering a granular look into market sentiment and positioning.

Instead of relying on lagging tools like RSI or MACD, traders learn to interpret live buy and sell activity to predict short-term moves more accurately. This perspective can provide a substantial advantage, particularly for those aiming to trade in sync with institutional players rather than behind them.

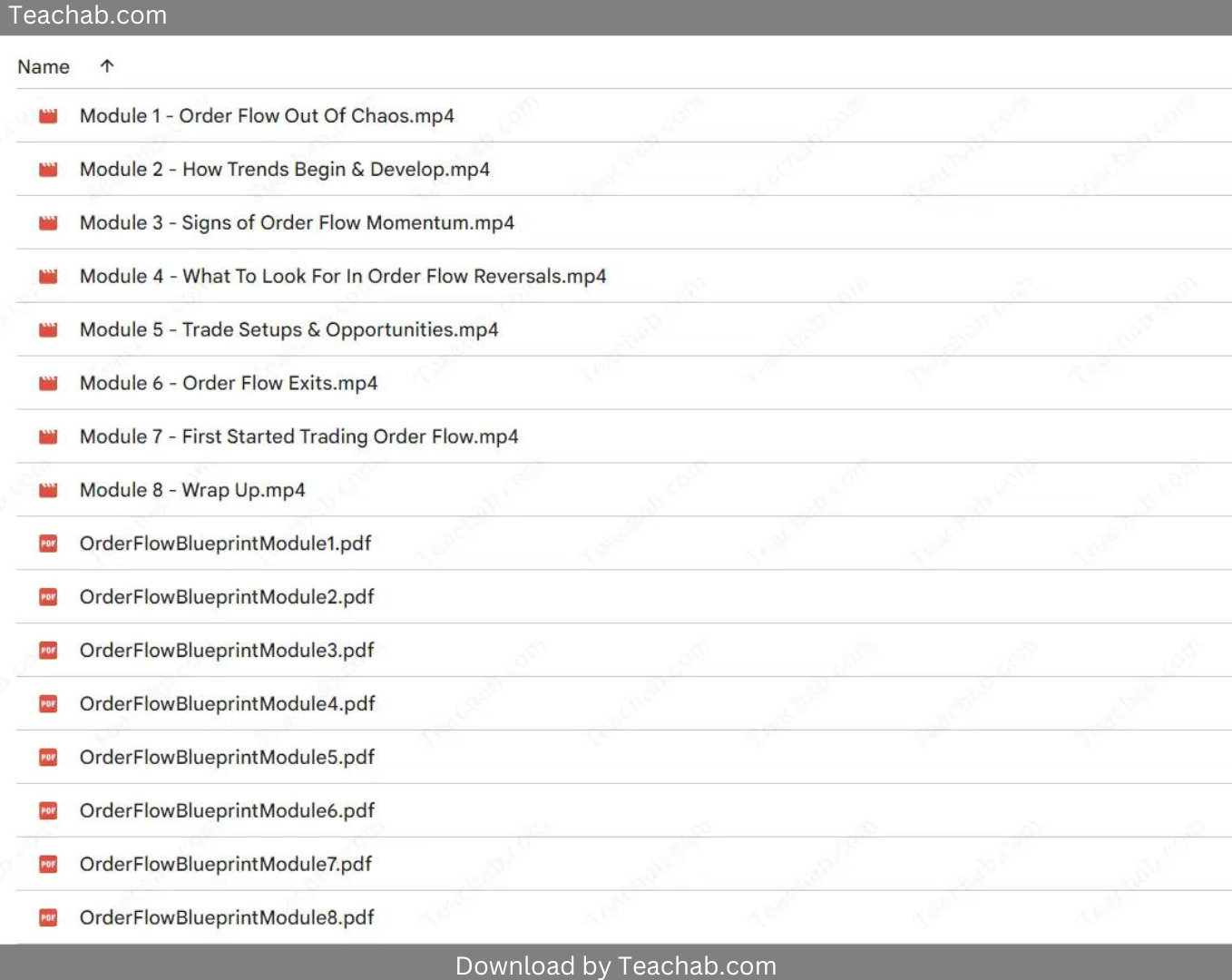

What the Course Delivers

The Orderflows Blueprint Trading Course offers a comprehensive curriculum designed to teach traders how to read and analyze order flow charts. These visualizations offer insights into trade volume, market depth, and the behavior of large participants. With this knowledge, traders can build strategies that capitalize on shifts in momentum and institutional activity.

The course includes a blend of foundational theory and practical tactics, ranging from the basics of order flow to sophisticated entry and exit techniques. It also comes bundled with proprietary software and specialized indicators created by Valtos himself, aimed at enhancing decision-making in real-time environments. These tools help bring the theoretical components of the course into practical, everyday use.

Why Order Flow Trading Stands Out

- Sharper Market Insight

Order flow analysis offers a much more precise view of market action than standard indicators. This clarity allows traders to better time their trades and spot hidden opportunities. - Real-Time Responsiveness

Because order flow is based on live market data, it enables quicker reactions to changes—ideal for active traders who need to move fast. - Strategic Positioning

Observing institutional behavior can help traders align themselves with the “smart money,” increasing the odds of riding momentum instead of getting caught in reversals.

Instant Download The Orderflows Blueprint Trading Course by Mike Valtos

A Side-by-Side with Traditional Technical Analysis

When measured against traditional trading methods, order flow analysis can be likened to painting with bright colors versus working with muted pastels. Traditional analysis often relies on indicators that react to price movements, while order flow analysis provides a proactive approach. Here’s a comparative overview:

| Aspect | Order Flow Analysis | Traditional Technical Analysis |

|---|---|---|

| Primary Focus | Real-time trade data | Historical price indicators |

| Decision Style | Proactive | Reactive |

| Market Insight | Detailed participant behavior | Broad pattern recognition |

| Ease of Learning | Steep due to complexity | Generally beginner-friendly |

Trader Feedback: Praise and Pitfalls

The course has attracted both enthusiastic endorsements and a few pointed criticisms. Many students praise Valtos’s expertise and the overall depth of the curriculum.

Pros Highlighted by Users

- Strong Educational Foundation: Students frequently commend the amount of actionable information, noting that it reshaped how they view market activity.

- Real-World Relevance: The emphasis on practical application means learners can directly implement strategies into their own trading setups.

Common Concerns

- Customer Support Shortcomings: Some users feel support could be more responsive, especially when troubleshooting software or asking follow-up questions.

- Software Stability: A recurring issue involves the platform occasionally freezing or becoming unresponsive during high-volume trading sessions, which can be problematic during crucial decision points.

The Challenge of Mastery: Tackling the Learning Curve

One of the most significant hurdles reported by new students is the initial complexity. Compared to more conventional trading education, order flow analysis requires a deeper level of focus and patience.

Strategies to Ease the Transition

- Time Investment: Set aside dedicated time for study and review. Rushing through won’t yield results.

- Peer Engagement: Join trading forums or mastermind groups where you can ask questions and share experiences.

- Simulated Practice: Before risking real capital, apply your learnings in a paper trading account.

- Manage Expectations: Progress takes time. Set milestones and recognize that consistent practice is key to success.

Final Thoughts

The Orderflows Blueprint Trading Course by Mike Valtos is a serious undertaking for traders looking to deepen their market understanding through order flow techniques. With its roots in institutional trading experience and a well-structured curriculum, it provides an effective framework for mastering advanced trading skills. However, the course is not without its limitations. Prospective students should weigh the value of the insights against the issues with customer support and the occasional hiccups with software reliability. For those who are ready to commit time and effort, this course may be the catalyst for a breakthrough in trading performance.

Like selecting the right brush for a painting, choosing a trading methodology is personal. But for those ready to dive into the deeper mechanics of price movement, Orderflows Blueprint may very well be the right tool to transform theory into trading mastery.